Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

Several articles came out recently arguing that the defeat of the Administration’s candidates in the last elections — only half of its Senatorial candidates won — was due to its bad economic performance, especially high prices. And that the current Administration is into economic protectionism while the previous Duterte administration was into economic liberalization.

I consider these points to be disinformation, and I will show why by the numbers.

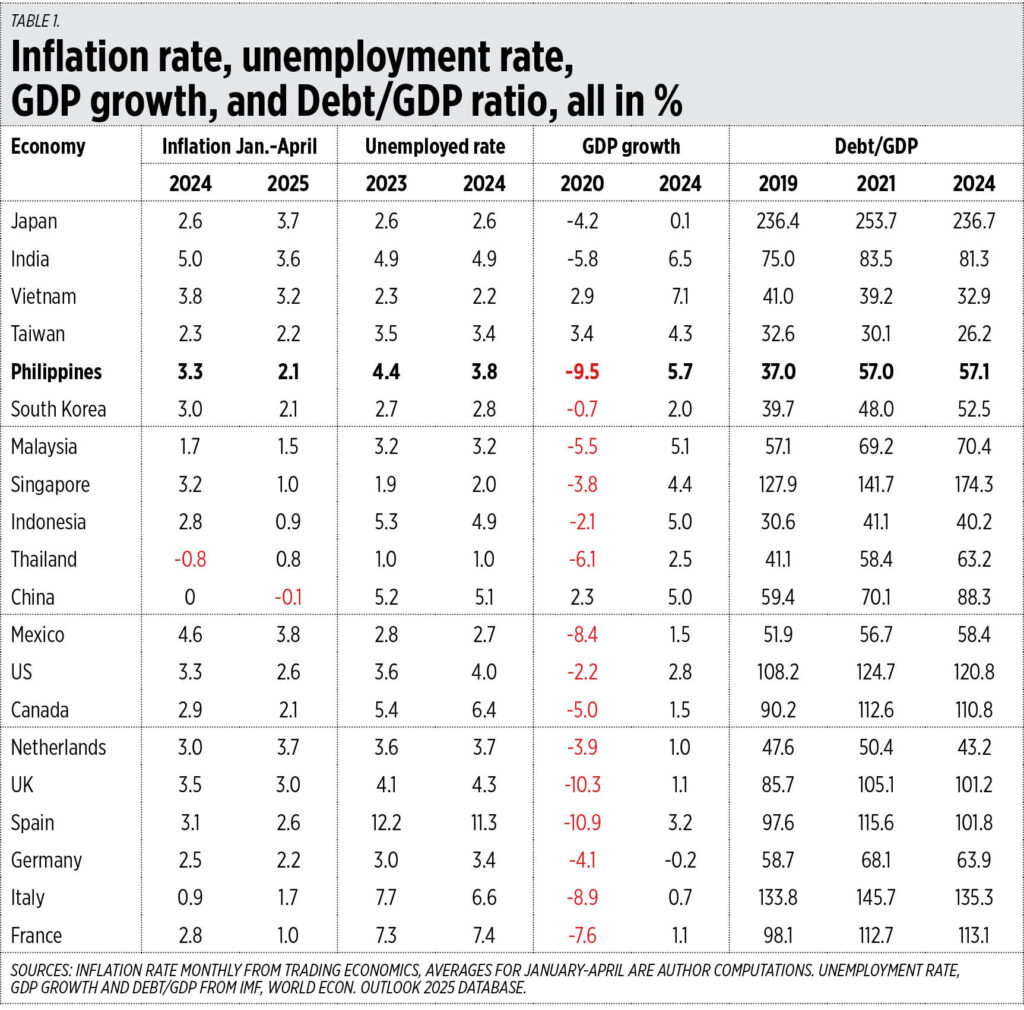

First, the Philippines’ inflation rate in March and April, or two months before the elections, was low, only 1.8% and 1.4%. The average for January to April was only 2.1%, much lower than that during the same period in 2024 of 3.3%. Four big Asian economies have higher inflation rates this year than the Philippines — India, Japan, Taiwan, and Vietnam. Many European nations plus the US and Mexico have had higher inflation than us this year.

Second, the Philippines’ unemployment rate has been on the decline — 3.8% in 2024 which is lower than that of China, India, and Indonesia. It is also lower than that of the US, Canada, and many European countries. More Filipinos now have jobs than in previous years.

Third, the Philippines under the Duterte administration had among the worst dictatorial economic policies in the whole world during the lockdown years of 2020-2021. Our economic contraction of -9.5% in 2020 was the worst in Asia, and it was the worst in Philippine economic history since WWII.

Fourth, the Philippines’ public debt jumped big time during the lockdown dictatorship of the previous administration. The public Debt/GDP ratio jumped from 37% in 2019 to 51.6% in 2020 and 57% in 2021. Many tax-paying shops were shut down, tax-paying individuals were prohibited from working, revenues plummeted while borrowings rose to the roof. Compared to many countries in the world, the Philippines’ scale of increase in Debt/GDP ratio from 2019 to 2021 was significantly higher (see Table 1).

The government’s economic team is doing good, they are pivoting the Philippines away from the trend of low growth in many countries, and even degrowth in Europe.

Others are blaming our supposed economic ills on our exchange rate policy, noting that the Peso is strong relative to the US Dollar and other currencies, so the solution is to depreciate and undervalue the Peso.

I consider this economic digression. The main concern of most Filipinos, not most exporters and traders, is price stability and the availability of more jobs. Our big economic problem is high government spending — that requires high taxation, high regulatory fees and penalties, and increased borrowings.

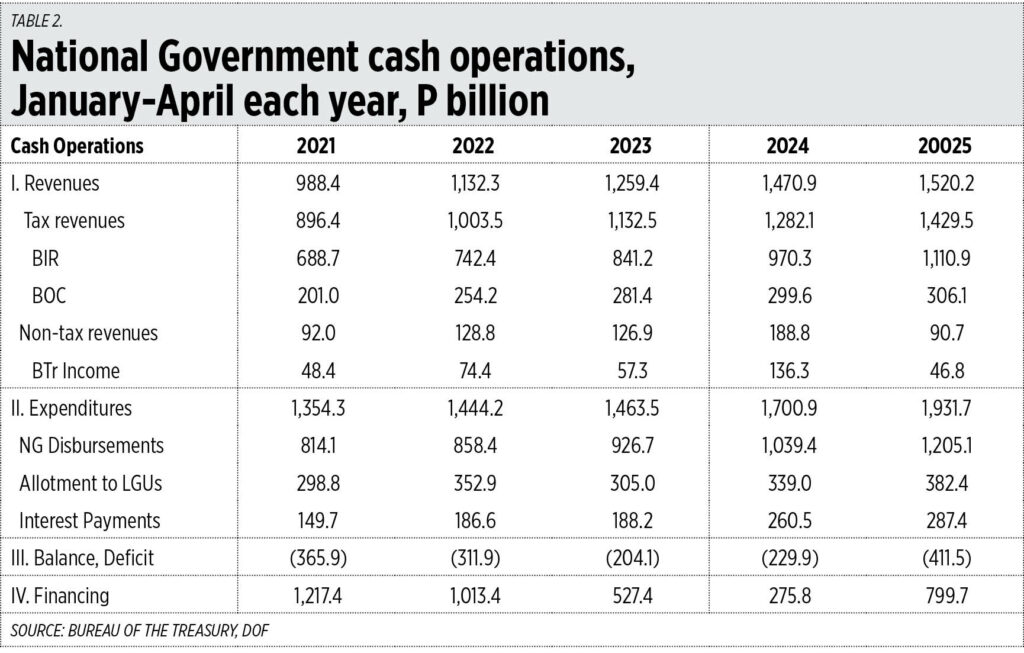

In 2024, our interest payment alone for our public debt was P763 billion or an average of P2.1 billion a day. In the first four months of 2025, our interest payment was P287 billion or an average of P2.4 billion a day.

Revenues are rising, both tax and non-tax. Finance Secretary Ralph G. Recto is improving tax administration and raising non-tax revenues via larger remittances by government corporations and banks.

But the bigger problem is expenditures, both those of the National Government (NG) and local government units (LGUs) spending — they rise much faster than the rise in revenues. For instance, for the first four months of 2025 vs same months of 2024, revenues increased by 11.5% but expenditures increased by 13.6%, led by NG’s 15.9% and LGUs’ 12.8%. Results are predictable: the budget deficit expanded big time, and financing or borrowings also expanded multiple times (see Table 2).

Since LGUs have a rising share of national taxes and they are taking on more functions, NG disbursements and spending should have stepped back, but this is not happening.

I want to mention special spending on the military and uniformed personnel (MUP) pension. MUPs (military, police, coast guard, firemen, etc.) have never contributed for their own retirement pension — they make no salary deductions for this unlike government doctors and nurses, government teachers and educators, government engineers and agriculturists, and so on.

So, taxpayers were burdened with having to fund an average of P120 billion/year from 2021-2024 for MUP pensions alone, on top of the annual budget for salaries, allowances, and operations of active MUP. This freebie pension should stop, but many legislators, NGOs, and professional and business organizations are perhaps scared to speak up about this fiscal burden. The President and several honest MUPs who understand the burden to taxpayers should speak up about this.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.