Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

Richmond Mercurio - The Philippine Star

January 26, 2026 | 12:00am

The Philippine Stock Exchange index (PSEi) fluctuated with sharp increases and declines last week, eventually finishing in negative territory at 6,333.26 Friday.

STAR / File

MANILA, Philippines — Stocks are expected to remain trading sideways this week, with upcoming economic data serving as potential catalyst.

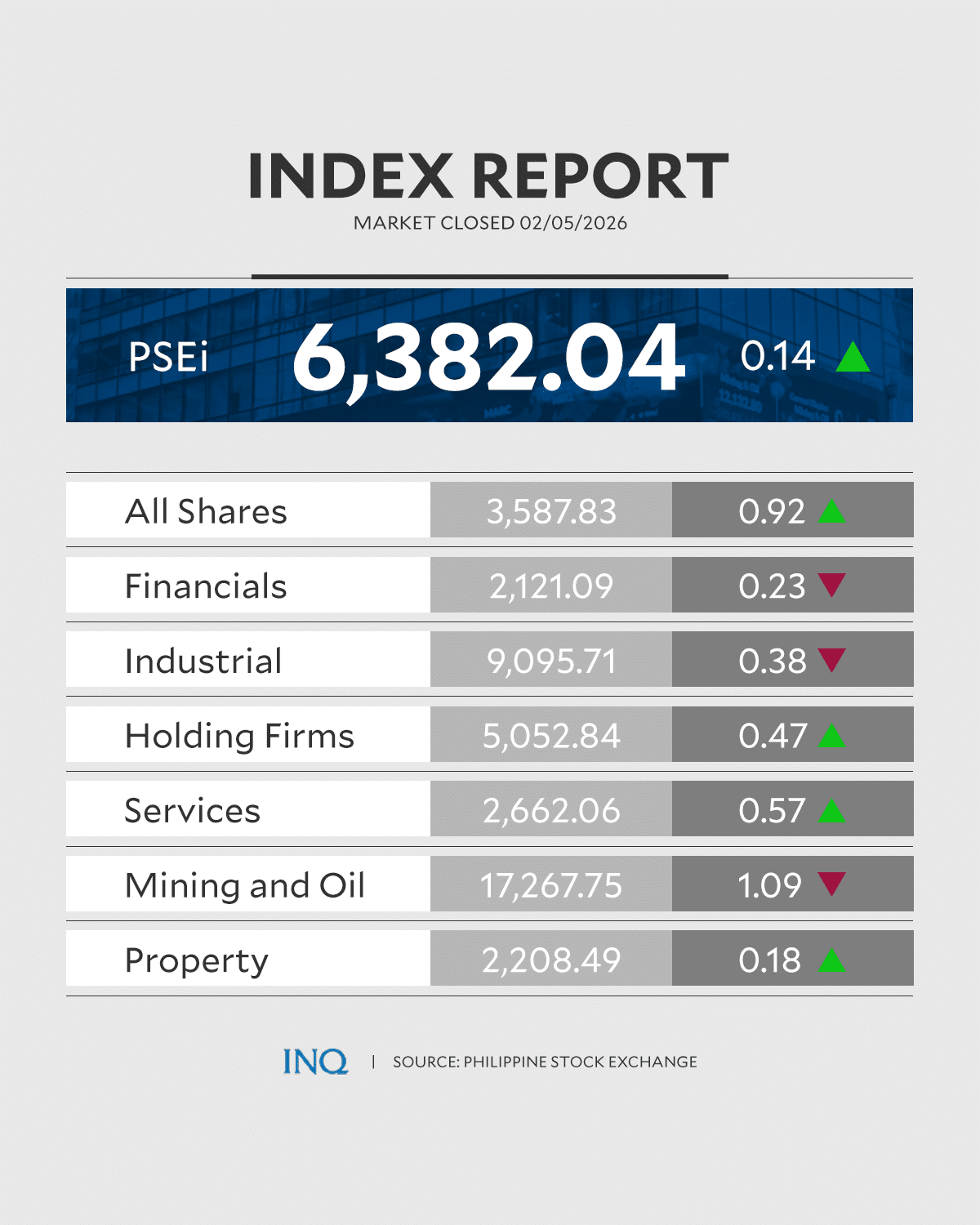

The Philippine Stock Exchange index (PSEi) fluctuated with sharp increases and declines last week, eventually finishing in negative territory at 6,333.26 Friday.

Week-on-week, the PSEi fell by 2.03 percent, while the broader All Shares index declined by 1.45 percent.

First Metro Investment Corp. head of research Cristina Ulang said the market could be on consolidation or sideways mode with investors cautious ahead of Philippine growth data.

Results of the country’s full year 2025 gross domestic product (GDP) growth will be reported on Jan. 29.

Unicapital Securities head of research Wendy Estacio-Cruz said GDP growth is likely to come in below the government’s target range of 5.5 to 6.5 percent for 2025.

“For the week ahead, the PSEi is expected to trade sideways with a cautious bias, as investors remain selective amid mixed global cues, with selective bargain hunting likely to provide near-term support,” she said.

Meanwhile, Philstocks Financial research manager Japhet Tantiangco said at current levels, the local market is deemed attractive.

“The local market snapped its four-week rally last week as offshore trade and geopolitical concerns weighed on investor sentiment. In the decline, the bourse gave up its position above the 6,400 level,” he said.

Tantiangco said the market’s trading range is seen from 6,150 to 6,400 this week.

Aside from the upcoming GDP data, Tantiangco said investors are also expected to monitor the US’ moves as it continues its pursuit of Greenland.

He said investors may also take cues from the movement of the local currency, with the continued peso recovery expected to help the market.

“Chartwise, the local market is still considered to be on an uptrend. Its 50-day and 200-day exponential moving averages are about to form a Golden Cross which is a bullish signal,” Tantiangco said.

“However, we’re also starting to see signs that the market’s momentum is waning. In last week’s trading, the market fell below both the 6,400 level as well as its 10-day exponential moving average. Its MACD (moving average convergence/divergence) line has already crossed below the signal line signaling bearish movements in the short run,” he said.

.png) 1 week ago

8

1 week ago

8