Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

Perth, June 11, 2025 (GLOBE NEWSWIRE) --

Perth, Western Australia/ June 11, 2025/ Perseus Mining Limited (ASX/TSX: PRU) (Company) is pleased to provide its gold production and All-In Site Cost (AISC) outlook for the five-year period from FY26 to FY30 inclusive for its portfolio of mines located in Ghana, Côte d'Ivoire and Tanzania.

The Five-year Operating Outlook incorporates the updated planning outlook for each of Perseus's three existing operations based on planning assumptions reflecting current operating conditions. It also takes into account Final Investment Decisions (FID) for the CMA underground mining operation at the Yaouré Gold Mine in Côte d'Ivoire (see ASX announcement "Perseus Mining takes Final Investment Decision on CMA underground project at Yaouré” dated 28 January 2025), as well as the development of the Nyanzaga Gold Project (NGP) in Tanzania (see ASX announcement "Perseus Mining proceeds with development of the Nyanzaga Gold Project” dated 28 April 2025).

HIGHLIGHTS

Get the latest news

delivered to your inbox

Sign up for The Manila Times newsletters

By signing up with an email address, I acknowledge that I have read and agree to the Terms of Service and Privacy Policy.

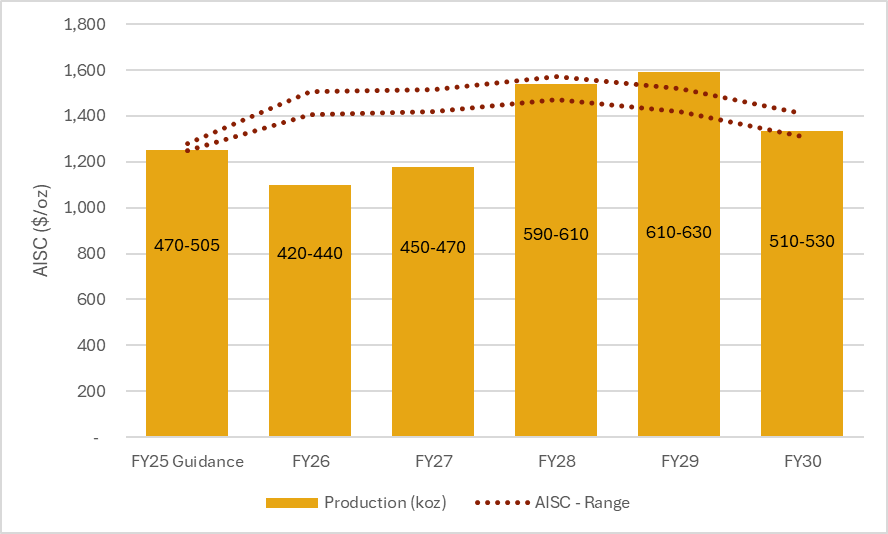

- Perseus expects to recover at total of 2.6Moz - 2.7Moz of gold with average gold production from the four operating mines of approximately 515koz - 535koz per annum in the five-year period to the end of FY30.

- The weighted average AISC over the five-year period is forecast to be US$1,400/oz - US$1,500/oz with not more than ±10% change year-on-year over the period, emphasising the benefit of our portfolio approach to asset management.

- Total development capital of ~US$878M that has been allocated to the operating assets during the period to achieve this production outlook is excluded from the AISC estimate.

- At a long-term gold price of US$2,400/oz, Perseus's cash operating margin is expected to consistently exceed US$500/oz at all mines over the five-year period. In some cases, it is significantly higher.

- The five-year outlook is underpinned by a high level of geological and technical confidence with 93% of the gold ounces in the mine plan comprising existing Ore Reserves with the remaining 7% from Measured or Indicated Mineral Resources. Inferred Mineral Resources and other upside projections of mineralisation were specifically omitted from Perseus's five-year outlook.

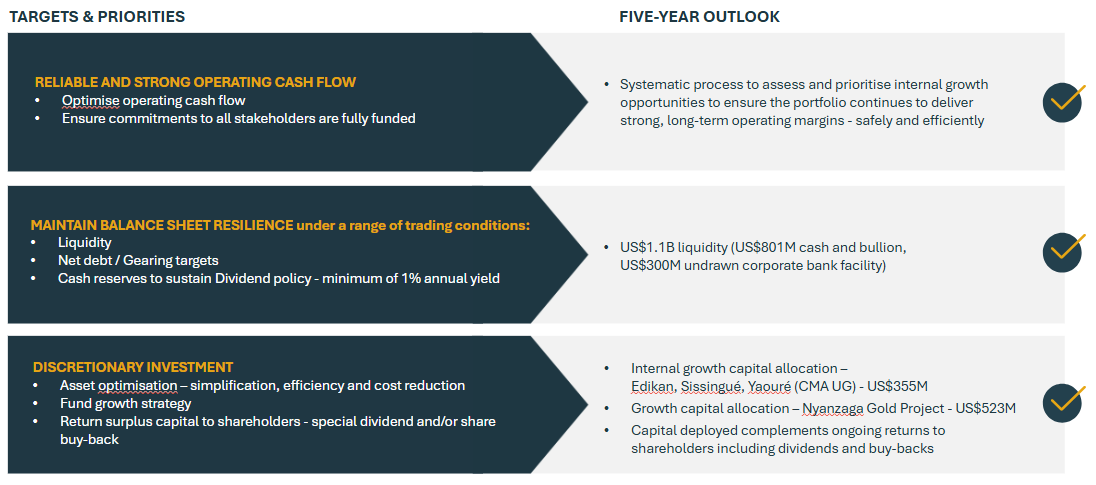

- The five-year outlook reinforces Perseus's commitment to the three core components of its capital allocation policy, namely: maintenance of a resilient balance sheet, delivery of strong, consistent operational performance and careful deployment of discretionary capital for growth and capital returns to shareholders.

Perseus's CEO and Managing Director, Jeff Quartermaine said:

"In FY22, Perseus's gold production reached approximately 500,000 ounces for the first time and set in train our ambition to maintain or exceed this level of production on a consistent basis going forward.

Perseus's decision in 2023 to defer development of its Meyas Sand Gold Project in Sudan and pivot towards acquisition and development of the Nyanzaga Gold Project, will lead to a short term shortfall in 2026 and 2027 relative to this target. From the five-year outlook published today, it is clear that this is a temporary setback and that Perseus's strategy of consistently producing between 500,000 to 600,0000 ounces of gold per year at a cash margin of not less than US$500 per ounce, is eminently achievable.

With cash and undrawn debt capacity currently exceeding US$1.1 billion, Perseus is fully funded to not only deliver the five-year outlook as presented today but also consider a prudent mix of future growth opportunities beyond the current plan, as well as generous returns to shareholders”.

Group Outlook

Perseus's five-year outlook delivers on the Company's strategy of building a sustainable, geopolitically diversified, African-focused gold business of three to four operating mines that produce between 500koz to 600koz of gold per annum at a cash margin of not less than US$500/oz.

As part of its annual planning cycle, the Company has reassessed the growth opportunities available within its portfolio with the approach of optimising the portfolio rather than focussing on fixed investment targets for each asset. In this way, the Company has sought to find the balance between investment in growth opportunities and the cash margin generated by the business.

Average gold production for the group over the five-year period is 515koz - 535koz per annum for a total of 2.6Moz - 2.7Moz with Yaouré contributing 34%, Edikan contributing 28% and Sissingué contributing 10%. Based on the current schedule, the recently committed NGP in Tanzania is anticipated to provide 28% of the metal production for the portfolio over the next 5 years.

The Company's weighted average AISC over the five-year outlook is estimated at US$1,400/oz - US$1,500/oz. AISC rises slightly in the first two years, driven by lower production base. In FY28, the integration of lower-margin ore sources into the mine plan contributes to a slight increase in AISC. The portfolio's diverse production base allows AISC to remain within ±10% of the five-year average on a year-to-year basis.

Figure 1 Perseus Group five-year gold production and AISC cost outlook

The Company has strong confidence in its ability to deliver on this five-year outlook, which is underpinned by a mine plan with high geological and technical certainty, with 93% of the production ounces forming part of the existing Ore Reserves with the remaining 7% from Measured or Indicated Mineral Resources (as detailed in ASX announcement "Perseus Mining updates Mineral Resources and Ore Reserves” dated 21 August 2024). Nyanzaga Ore Reserves are detailed in ASX announcement "Perseus Proceeds with Development of Nyanzaga Gold Project” dated 28 April 2025. The Company will provide an update to the Mineral Resource and Ore Reserve statement in August 2025, in line with its annual disclosure.

Incremental production included in the mine plan at Yaouré, Edikan and Sissingué comes from well-understood deposits with a proven operating history. This production does not require significant additional infrastructure or capital beyond the investment necessary to access the mineralisation.

Table 1 Five-year production outlook, AISC and development capital forecast

| ASSET | TOTAL PRODUCTION

5-YEAR OUTLOOK | AISC 5-YEAR RANGE1 | TOTAL DEVELOPMENT CAPITAL 5-YEAR |

| Yaouré | 870koz - 905koz | $1,480/oz - $1,580/oz | US$170M2 |

| Nyanzaga | 725koz - 750koz | $1,230/oz - $1,330/oz | US$523M3 |

| Edikan | 720koz - 750koz | $1,450/oz - $1,550/oz | US$180M4 |

| Sissingué | 265koz - 275koz | $1,580/oz - $1,680/oz | US$5M |

| TOTAL | 2,580koz - 2,680koz | $1,400/oz - $1,500/oz | US$878M |

1) AISC includes sustaining capital but excludes development capital

2) Yaouré Development capital relates to capitalised underground development and includes US$21M forecast to be incurred to 30 June 25

3) Includes development and pre-production capital cost incurred post-FID up to first gold pour. In addition it includes US$38M forecast to be incurred to 30 June 25

4) Development capital relates to capitalised waste stripping costs at Esuajah North and Fetish deposits and development capital for ESS Underground

Table 2 Portfolio key production indicators by year

| Key Production Indicators | Units | FY26 | FY27 | FY28 | FY29 | FY30 | 5-year totals |

| Open Pit | |||||||

| Ore Mined - Open pit | Mt | 11.7 | 12.2 | 14.8 | 17.1 | 10.5 | 66.2 |

| Ore Grade Mined - Open pit | g/t | 1.10 | 1.06 | 1.18 | 1.25 | 1.41 | 1.20 |

| Total Mined - Open pit | Mt | 52.9 | 103.0 | 102.6 | 87.1 | 63.4 | 409.1 |

| Strip Ratio | t:t | 3.54 | 7.43 | 5.93 | 4.10 | 5.05 | 5.18 |

| Underground | |||||||

| Ore tonnes - Underground | Mt | 0.2 | 0.6 | 1.0 | 2.1 | 2.0 | 5.8 |

| Ore Grade Mined - Underground | g/t | 3.51 | 3.36 | 3.13 | 1.27 | 1.48 | 1.94 |

| Total Tonnes Mined - Underground | Mt | 0.5 | 0.9 | 1.5 | 2.6 | 2.1 | 7.6 |

| Milling | |||||||

| Ore Milled | Mt | 12.7 | 14.5 | 16.5 | 15.8 | 12.8 | 72.3 |

| Ore Grade Milled | g/t | 1.18 | 1.10 | 1.26 | 1.37 | 1.42 | 1.27 |

| Recovery | % | 85% - 90% | 85% - 90% | 85% - 90% | 85% - 90% | 85% - 90% | 85% - 90% |

| Gold Produced | koz | 420-440 | 450-470 | 590-610 | 610-630 | 510-530 | 2,580-2,680 |

Capital Allocation

Perseus is in a strong financial position, with a resilient balance sheet and an operational portfolio that continues to safely and efficiently generate reliable operational cash flow. This allows the Company to look to deploy operating cashflow to shareholders and other stakeholders in the business. Figure 2 summarises Perseus's capital allocation priorities.

Figure 2 Perseus capital allocation priorities

The five-year outlook is the result of a systematic process to assess and prioritise internal growth opportunities to ensure the portfolio continues to deliver strong operating margins over the long term. The deployment of capital within the business complements existing capital management strategies, including a share buyback programme and the payment of dividends.

While Perseus continues to consider inorganic growth opportunities, these are required to compete rigorously for discretionary investment and be assessed in the context of overall business risk and delivery of value. By allocating discretionary capital to internal organic growth, Perseus can invest in jurisdictions where it has an established operating presence, on known geological terranes, and with a proven workforce capable of safely and efficiently delivering value.

Yaouré Gold Mine

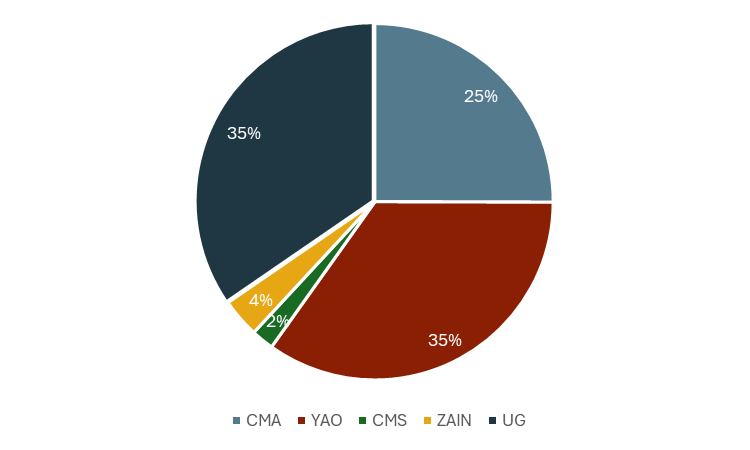

The five-year forecast for Yaouré includes mining of the recently started Yaouré open pit and CMA underground as the primary ore sources. Supplementing the primary ore sources, material is also sourced from Zain, CMA Southwest and long-term stockpiles to maximise mill capacity.

Figure 3 Yaouré Gold Mine - Percentage five-year metal production by source

Yaouré will continue to be a cornerstone asset in Perseus's portfolio, total gold production of 870koz - 905koz and a weighted average AISC of $1,480/oz - $1,580/oz over the five-year outlook. While FY26 sees a reduction in gold produced compared to previous years, the change in production volume was anticipated and is a result of a combination of factors including change in ore characteristics and material sources (as detailed in the ASX announcement "Perseus extends life of the Yaouré Gold Mine to 2035” dated 18 September 2023).

Table 33 Yaouré key production indicators, five-year outlook

| KEY PRODUCTION INDICATORS | UNITS | FY26 | FY27 | FY28 | FY29 | FY30 | TOTAL 5-YEAR OUTLOOK |

| Open Pit | |||||||

| Ore Mined - Open pit | Mt | 4.3 | 2.8 | 3.7 | 5.7 | 2.6 | 19.2 |

| Ore Grade Mined - Open pit | g/t | 1.06 | 1.08 | 0.98 | 0.99 | 1.14 | 1.04 |

| Total Mined - Open pit | Mt | 26.1 | 28.6 | 30.5 | 27.9 | 12.2 | 125.2 |

| Strip Ratio | t:t | 5.02 | 9.15 | 7.17 | 3.90 | 3.70 | 5.53 |

| Underground | |||||||

| Ore tonnes - Underground | Mt | 0.2 | 0.6 | 0.8 | 0.8 | 0.8 | 3.2 |

| Ore Grade Mined - Underground | g/t | 3.51 | 3.36 | 3.43 | 3.33 | 3.80 | 3.49 |

| Total Tonnes Mined - Underground | Mt | 0.5 | 0.9 | 1.1 | 0.9 | 0.8 | 4.1 |

| Milling | |||||||

| Ore Milled | Mt | 3.7 | 3.8 | 3.6 | 3.4 | 3.4 | 17.9 |

| Ore Grade Milled | g/t | 1.66 | 1.43 | 1.69 | 1.89 | 1.85 | 1.70 |

Following FID on the CMA underground operation in January 2025, the project is due to cut the first of four underground portals in Q1 FY26. The expansion to include underground operations allows further exploitation of the CMA deposit, which has proven to be a reliable and well understood geological domain of the Yaouré operation to date. At steady state production, it is planned that underground ore will represent approximately 20% of the tonnes of ore mined on the site from both open cut and underground operations.

Since approving FID, Perseus has worked with its mining contractor to further develop the mine schedule ahead of commencement of underground operations in Q1 FY26. This milestone is aligned to the project schedule detailed in ASX announcement "Perseus Mining takes final investment decision on CMA Underground Project at Yaouré” dated 28 January 2025. As of this update, changes to the underground schedule have resulted in the development capital allocated for the CMA underground increasing by 36% from the approved US$124.6M to US$170M. Development capital for CMA Underground has increased due to bringing forward underground development into the pre-commercial production period and updated capitalisation methodology to include royalties and G&A previously expensed.

Further optimisation of the Yaouré life of mine plan is scheduled as several on-lease targets are assessed as part of the regular mine planning process.

Nyanzaga Gold Mine

Nyanzaga is forecast to be the lowest cost operation in the Perseus's portfolio. Gold production totals 725koz - 750koz, with peak metal output in FY28 over the five-year outlook. The weighted average AISC ranges between US$1,230/oz - US$1,330/oz. Nyanzaga's increasing contribution to Perseus's portfolio underscores the decision to acquire and proceed with project development.

During the five-year period, all of the Nyanzaga's Kilimani pit is mined providing initial ore supply to the mill with the remainder of the material sourced from the main Nyanzaga deposit. All material mined is part of the stated Ore Reserve (see ASX announcement "Perseus Mining proceeds with development of the Nyanzaga Gold Project” dated 28 April 2025).

Total gold production over Nyanzaga's current 11-year life of mine, Phase 1 mine production is currently estimated to be 2.01 Moz based on a JORC 2012 Probable Ore Reserve of 52.0 Mt @ 1.40 g/t gold for 2.3 Moz. The development capital cost for the plant and site infrastructure is estimated at US$472M inclusive of US$49M of contingency, and pre-production capital of US$51M, giving a total capital cost to first gold pour of US$523M.

Table 44 Nyanzaga key production indicators - five-year outlook

| KEY PRODUCTION INDICATORS | UNITS | FY26 | FY27 | FY28 | FY29 | FY30 | TOTAL 5 YEAR OUTLOOK |

| Open Pit | |||||||

| Ore Mined - Open pit | Mt | - | 1.8 | 6.3 | 6.2 | 6.2 | 20.5 |

| Ore Grade Mined - Open pit | g/t | - | 1.02 | 1.37 | 1.39 | 1.25 | 1.31 |

|

This website uses cookies. By continuing to browse the website, you are agreeing to our use of cookies. Read More. | |||||||

1 day ago

12

1 day ago

12