Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

Already have Rappler+?

to listen to groundbreaking journalism.

This is AI generated summarization, which may have errors. For context, always refer to the full article.

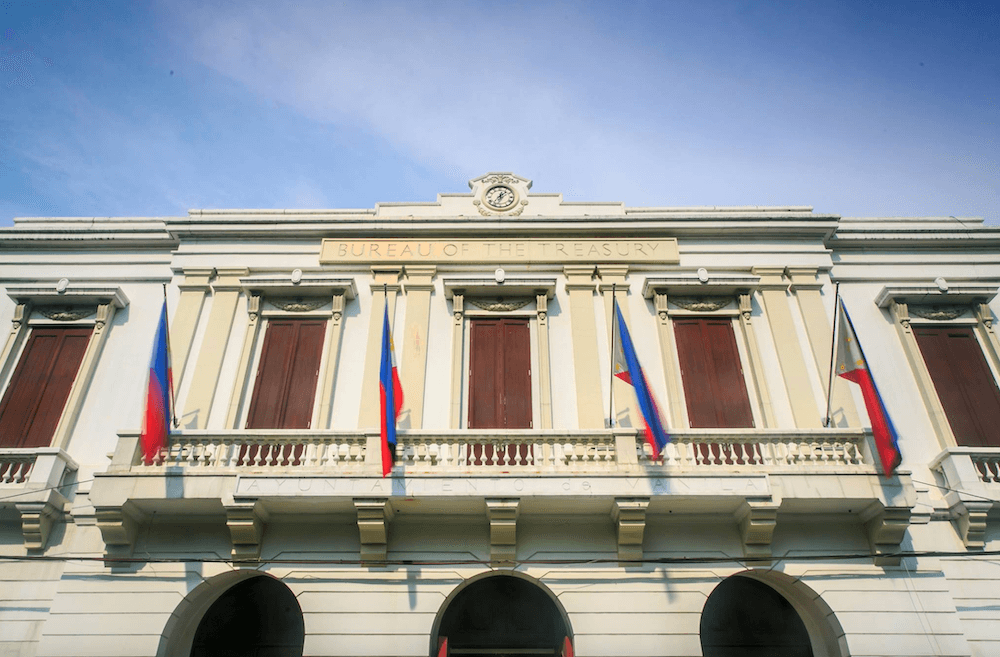

PHILIPPINE TREASURY. The facade of the Bureau of the Treasury in Manila.

Bureau of the Treasury

The latest debt figure places the country's debt-to-GDP ratio at 60.7%

MANILA, Philippines – The Philippines’ national debt pile grew 9.8% to P16.05 trillion in 2024 amid a weaker peso and additional financing taken on by the national government, data from the Bureau of the Treasury showed.

The total outstanding debt is slightly lower than the Marcos Jr. administration’s Budget of Expenditures and Sources of Financing (BESF) projections of P16.06 trillion.

The Treasury cited the government’s borrowing of an additional P1.31 trillion in line with its deficit program.

The depreciation of the Philippine peso against the US dollar also added an additional P208.73 billion to the total debt value. But this was partially offset as the stronger greenback made obligations in other currencies slightly cheaper.

The peso ended 2024 at P57.847 against the dollar, the Treasury said.

Domestic debt continues to take up most of the government’s obligations, comprising P10.93 trillion. Meanwhile, the country added P522.55 billion more in foreign debt, bringing external obligations to P5.12 trillion.

Debt-to-GDP ratio

The latest debt figure places the Philippines’ debt-to-gross domestic product (GDP) ratio at 60.7%.

“The corresponding debt-to-GDP ratio of 60.7% was slightly above the 60.6% revised Medium-Term Fiscal Framework estimate, on account of the lower-than-expected full-year real GDP growth outcome of 5.6%,” the Treasury wrote.

The Philippines’ GDP grew 5.2% in 2024, failing to meet the government’s growth target for a second year in a row.

While the debt-to-GDP ratio is an improvement from the 17-year high of 63.7% in 2022, Rizal Commercial Banking Corporation’s chief economist Michael Ricafort noted that it remains above the international threshold of 60%.

Ricafort said the government will need to implement tax and fiscal reforms to bring the debt-to-GDP ratio back to international thresholds and maintain the country’s favorable credit ratings.

“Priority would be the intensified tax collections from existing tax laws and encouraging compliance with the payment of the correct taxes and to run after tax cheats,” he wrote in an email.

A country’s debt-to-GDP ratio is often an indicator of its ability to pay back its obligations. A lower debt-to-GDP ratio often shows that a country has a healthy economy that can produce and sell goods without taking on too much debt. – Rappler.com

How does this make you feel?

Loading

5 months ago

21

5 months ago

21