Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

First Metro Securities Brokerage Corp., in its Nov. 28 Market Focus report produced by Mark Angeles and Estella Villamiel, sees the Philippine equity market standing at a crossroads.

According to the report, Philippine equities have underperformed regional peers year-to-date, sliding to a five-year low in mid-November. This weakness, the Metrobank Group brokerage firm pointed out, reflects confidence shocks stemming from a series of calamities and ongoing corruption probes that disrupted both public and private sector activity.

Additionally, the report said, a narrowing interest rate differential between the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve (Fed) weighed on the peso, pushing the currency near historic lows.

While corporate earnings have broadly met expectations, the report said, valuations remain depressed, with equity risk premia elevated near crisis levels and underscoring a cautious investment environment.

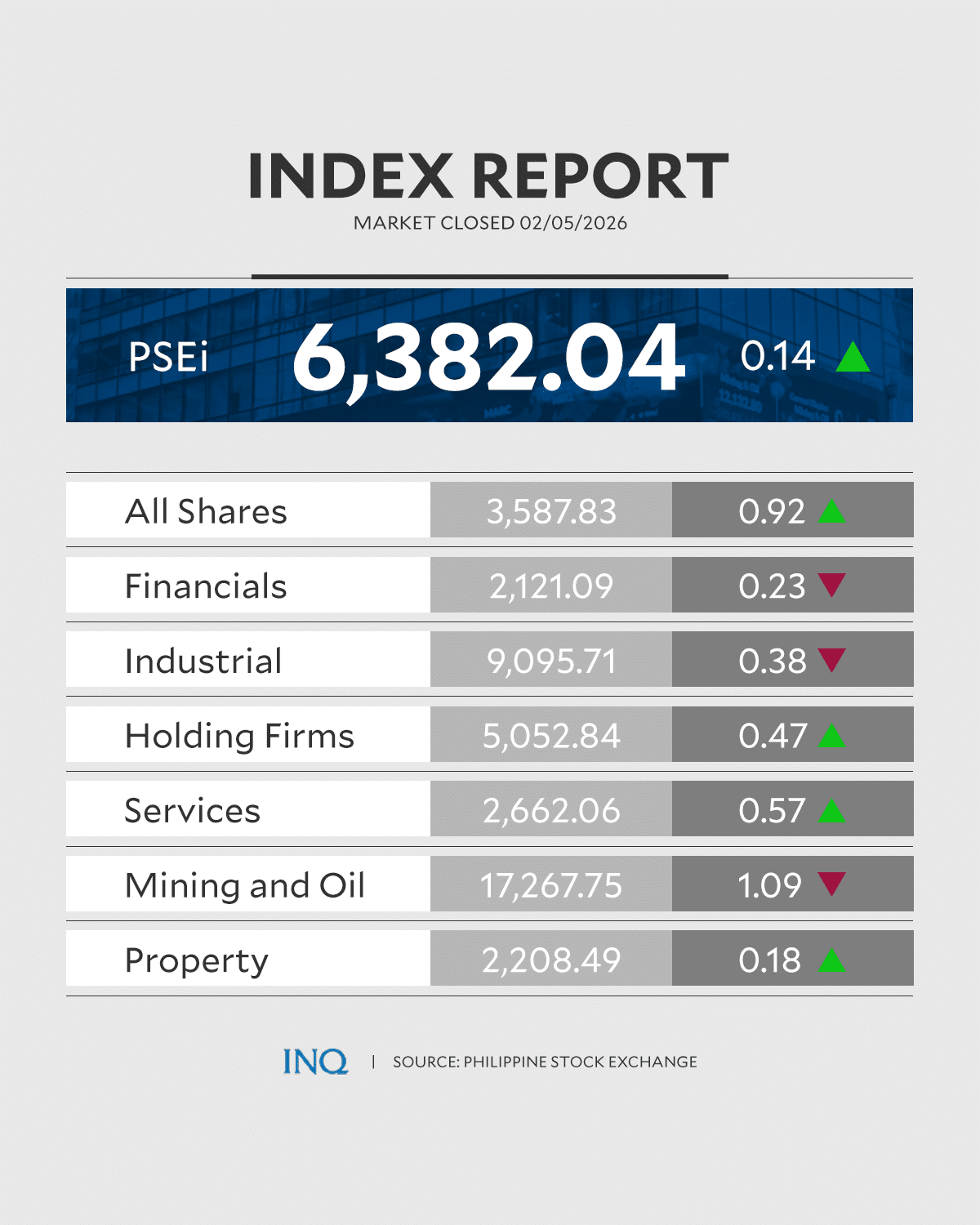

Looking ahead to 2026, they project an index target range of 5,500 to 7,500, with a base case of 6,500. For now, they observe that the market appears poised to take the familiar route: a “muddle-through” path as caution persists over the next 12 months.

However, First Metro Securities sees an 8.9 percent upside toward their base case scenario, but this will come from moderate EPS (earnings per share) growth, reflecting a soft macro environment, rather than meaningful valuation expansion.

As such, the brokerage firm expects ERP (equity risk premium) to remain elevated at 600 bps, as uncertainties over macro stability and confidence issues linger. The implied forward P/E (price to earnings) of 9.8x suggests only marginal improvement from current levels. It added that much of the valuation damage has been priced in, so that any underperformance will be limited.

Despite First Metro Securities’ cautious stance, they believe a return of confidence could unlock a more constructive outcome. With negatives already understood by the market and risk appetite fragile, a modest sentiment shift is more likely to catalyze a positive outcome than a negative one.

They add that a slide toward their bear case of 5,500 would require a deeper erosion of confidence and materially weaker-than-expected economic or earnings growth. Conversely, they said that catalysts to restore investor confidence and lead to a more constructive outcome are clearer. They cite three scenarios that could steer the market toward their bull case target of 7,500.

These are:

1. Governance reforms and normalization of public spending — decisive progress in governance reforms, transparency and more efficient execution of public projects will restore confidence, improve fiscal discipline and lay the foundation for renewed economic momentum.

2. Economy humming – macro stability, with the Philippine economy firing on all cylinders, they believe, will shift the narrative from weakness to outperformance. Above-potential GDP growth, a return to historical earnings trends and supportive monetary policy will result in meaningful contraction of equity risk premia.

3. Market inundated by foreign funds flows - a strong return of foreign investors would drive multiples higher, and close the valuation gap with EM (emerging market) peers, enabling outperformance regardless of fundamentals.

Of the three scenarios, First Metro Securities see Scenario 1 (governance reforms) and Scenario 3 (foreign inflows) as more probable, explaining that governance reforms are achievable with sufficient political will, while foreign flows are already showing signs of recovery, with outflows tapering and rolling 52-week flows turning positive in recent weeks. Renewed inflows, particularly from passive funds, reflects growing consensus toward a more constructive outlook for emerging markets, they point out.

Over the next 12 months, the firm sees investors standing at a crossroads: “We see two investment themes diverge between the familiar, defensive playbook and the road less travelled.

“The familiar route favors dividend-paying names, particularly those with defensive drivers and/or the ability to capitalize on public social spending. These names provide stability in a “muddle-through” environment where risk premia remain elevated and confidence fragile. The less-travelled path, however, points to a more constructive outcome. In this scenario, we lean toward large-cap cyclicals positioned to benefit from economic recovery and a meaningful rebound in investor sentiment. While this path demands conviction, it offers the potential for meaningful upside beyond the comfort of the defensive playbook.

“Across our selection, we have preference for index names, which are best positioned to capture the potential return of foreign fund inflows, enabling outperformance regardless of fundamentals. In addition, an unmarked trail with AI diffusion beneficiaries represents an emerging theme we prefer to have an exposure to. Positioning for these two paths requires balance. Hence, we continue to advocate for a barbell strategy, anchoring portfolios in resilience while retaining exposure for potential upside.”

Their stock picks include Converge, PLDT, Globe, Meralco and BDO, which they consider are AI diffusion winners, elaborating that “although still nascent in the Philippine context, AI adoption is emerging as a structural theme, with long-term implications for productivity and competitiveness.”

The firm monitors companies that can integrate AI into operations, enhance customer engagement, or drive efficiencies in supply chain and service delivery.

They believe sectors with high operating leverage, such as banks, telcos and utilities, are best positioned to benefit from investments in AI.

Amid increasingly quantifiable productivity gains, they see structural earnings uplift and valuation rerating as AI-driven initiatives scale.

AREIT, RCR, Puregold, URC, along with PLDT, Globe and Meralco are dividend- and defensive-stock plays. First Metro Securities prefers stocks for dividend-paying counters, particularly those supported by robust cash flows and resilient business models.

Defensive positioning is critical in the current environment, as exposure to stable demand drivers provides an earnings hedge against a soft macro backdrop.

Large-cap cyclicals are BDO, BPI, SMPH, SM, ALI and JFC. The firm sees opportunities in cyclical sectors that can benefit from an economic recovery and return of investor confidence. These are: banks – which stand to benefit from credit expansion, aided by liquidity support from the central bank, as well as select property developers and consumer discretionary names – which should capture demand as confidence improves and household spending normalizes.

.png) 2 months ago

31

2 months ago

31