Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

Marco Luis Beech - The Philippine Star

January 12, 2026 | 12:00am

MANILA, Philippines — A former officer of the Philippine Navy will take the helm of life insurance firm Sun Life of Canada (Philippines) Inc., following the company’s announcement on Friday of the impending retirement of its current CEO.

When asked about the industry’s challenges, incoming Sun Life CEO Jonathan Moreno said that low financial literacy and a limited appreciation of the importance of life insurance remain key hurdles, adding that the company intends to push forward initiatives to address these concerns.

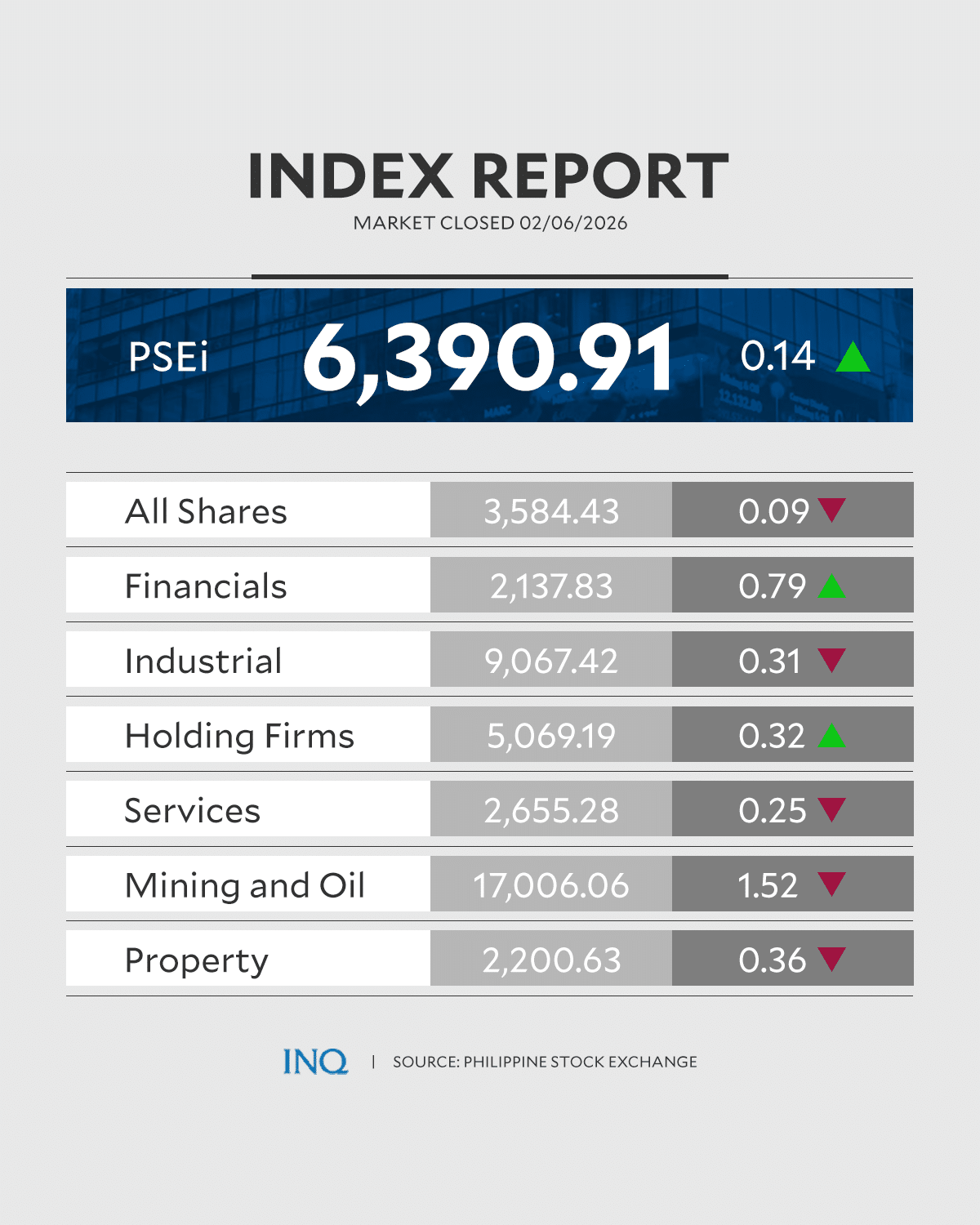

“Of course, the macroeconomic challenges as well, that will affect. Because we do have products that are linked to equities. Those are the things that affect the performance of the funds and the confidence on insurance,” Moreno said in a press briefing on Saturday.

Moreno will be the new CEO and country head of Sun Life effective April 1 this year while his predecessor, Benedict Sison, will continue to serve as a strategic advisor and chairman of Sun Life Philippines Holding Co. and Foundation until Dec. 31, 2026.

Moreno said he had previously served as a surface warfare officer in the Philippine Navy, noting that this experience had equipped him to manage multiple concerns simultaneously, which Moreno believes will help him lead the firm and guide its strategic direction moving forward.

In 2024, data from the Insurance Commission showed that Sun Life ranked as the country’s leading life insurer, posting a premium income of P57.14 billion.

Sison said Sun Life’s income as of end-2025 is higher, but declined to disclose the figures, noting that the company has only recently closed its books.

“I am very confident that we will sustain our leadership position by the end of this year, in 2025. So right now, officially, we are 14 years in total premium. Clearly we will be 15 years. I am confident and it’s a growth in total premium,” he said.

Sison will step down as Sun Life CEO upon his retirement, having served as the company’s head since 2018.

Despite prevailing economic factors, Sison said the firm remains optimistic, citing underpenetrated sectors, a growing middle-income population and increasing awareness of the benefits of life insurance.

Sun Life has minimal exposure to foreign exchange risks, Sison said, noting that while the firm holds some dollar-denominated assets, these are fully hedged.

.png) 3 weeks ago

17

3 weeks ago

17