Upgrade to High-Speed Internet for only ₱1499/month!

Enjoy up to 100 Mbps fiber broadband, perfect for browsing, streaming, and gaming.

Visit Suniway.ph to learn

Richmond Mercurio - The Philippine Star

December 3, 2025 | 12:00am

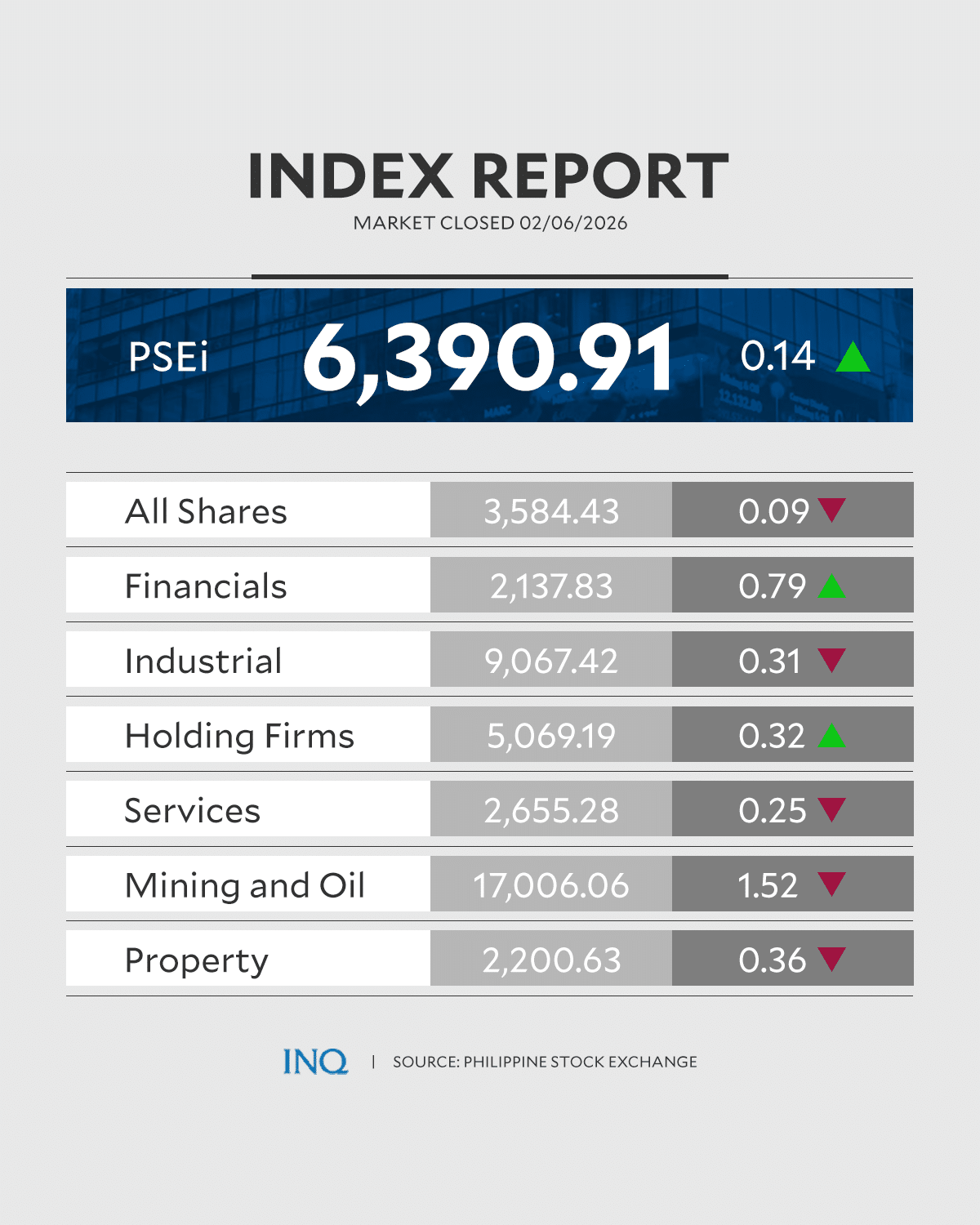

The PSEi inched up by 0.09 percent or 5.11 points to end yesterday’s session at 5,994.40.

Pixabay / File

MANILA, Philippines — The bellwether Philippine Stock Exchange index (PSEi) closed slightly higher amid bargain-hunting activities.

The PSEi inched up by 0.09 percent or 5.11 points to end yesterday’s session at 5,994.40.

The broader All Shares index, however, fell by 1.93 percent or 68.28 points, settling at 3,475.50.

Philstocks Financial research manager Japhet Tantiangco said that the local market’s sideways movement ended in the positive territory as investors hunted for bargains.

“Expectations of a tempered inflation last November and a BSP policy rate cut this December fueled positive sentiment,” Tantiangco said.

Sectors were dominated by those in the red, with mining and oil taking the biggest hit with a 1.44-percent drop.

Services and property indexes managed to end in the positive territory, up by 1.95 percent and 0.02 percent, respectively.

Total turnover value thinned to P5.49 billion from the previous day’s P6.48 billion.

Market breadth remained positive as advancers edged out decliners in a close contest, 97 to 95, while 59 issues were unchanged.

BDO Unibank was the session’s most active stock, declining by 1.54 percent to P127.50 per share, followed by ICTSI, which surged by 3.2 percent to P565 and BPI, which fell by 1.61 percent to P116.

First Metro Securities Research expect the market to trade with a mild upward bias this week as anticipated rate cuts from the BSP and US Federal Reserve draw closer.

Moreover, it said S&P’s reaffirmation of the Philippines’ “BBB+” credit rating suggests expectations for improving macro conditions, with the positive outlook hinting at a potential upgrade within 12 to 24 months if fiscal and economic trends continue.

.png) 2 months ago

41

2 months ago

41